Table of Content

- CalHFA and CalPLUS Conventional Loan Programs

- Closing Cost Assistance Programs for Home Buyers

- Basic Mortgage Requirements for First-Time Buyers in California

- Conventional Loans

- California First Time Home Buyer Programs

- Which loan is best for first-time home buyers?

- What is the average age of first-time homebuyers in California?

Applicants with a lower credit score may need to pay a down payment, but they will only be around 10% of your home’s value. That’s still a considerable discount from the typical 20% down payment requirement. To qualify, home buyers must earn less than 115% of the current U.S. median income. You will also have to prove that you have been unable to get a conventional loan.

Conventional loan borrowers may be eligible for a MyHome loan as well. But in this case the junior loan is up to 3% of the home purchase price . This 30-year fixed-rate FHA loan has a slightly higher interest rate than the FHA loan listed above but can be paired with CalHFA Zero Interest Program closing cost assistance. Learn more about FHA home loans below, including the requirements to get an FHA loan, the 2022 FHA loan limits, and an FHA mortgage calculator. A common question is if you can buy a house without your wife or husband. You may be able to qualify and get a home loan without your spouse.

CalHFA and CalPLUS Conventional Loan Programs

Perez, who recently purchased a home through the CalHFA School Program, has been sharing details about how she qualified to buy her house with other interested teachers. The CalHFA FHA Program is an FHA-insured loan featuring a CalHFA 30 year fixed interest rate first mortgage. An approved homebuyer counseling course can be taken online through eHome for $99, or in-person through a HUD-approved housing counseling agency or NeighborWorks America; fees vary by agency. Jerry writes about home equity, personal loans, auto loans and debt management. Bridgepoint Funding specializes in residential mortgages and serves borrowers and real estate agents throughout the entire state of California. While your credit definitely doesn’t have to be top-notch to get approval for a VA loan, it does need to fall somewhere in the middle of the credit spectrum.

In addition to taking advantage of any federal or state programs available to you, it’s also vital to shop around to get the best mortgage. Check with specific lenders and look at interest rates so you get the best possible terms. One of the newest state initiatives is the Forgivable Equity Builder Loan assistance program. The loan carries a 0% interest rate and if the recipient, who must qualify for a mortgage, stays in the home for five years the entire principal is forgiven. The CalPLUS FHA program is an FHA-insured first mortgage with a slightly higher 30 year fixed interest rate than our standard FHA program and is combined with the CalHFA Zero Interest Program for closing costs.

Closing Cost Assistance Programs for Home Buyers

The Department of Veteran Affairs also backs Native American Direct Loans . They do not require any down payment and carry a set interest rate. Currently, the interest rate is 4.5%, but it changes based on market and Prime Rate fluctuations.

No down payment is required on these loans to moderate-income borrowers that are guaranteed by the USDA in specified rural areas. Borrowers pay an upfront guarantee fee and an annual fee that serves as mortgage insurance. Active-duty members of the military, veterans, and eligible family members may apply for loans backed by the Department of Veterans Affairs. VA loans , to buy, build, or improve homes, have lower interest rates than most other mortgages and don’t require a down payment. Most borrowers pay a one-time funding fee that can be rolled into the mortgage. Very low- and low-income borrowers may make a 3% down payment on a Home Possible® mortgage.

Basic Mortgage Requirements for First-Time Buyers in California

Itizen’s Power Network, whicheducates students on the importance of voting and civic engagement, would not have had enough money to purchase their first home without the assistance. If so, please make your donation today to keep us going without a paywall or ads. FirstHomeAdvisor ® is an equal opportunity housing provider for first-time buyers.

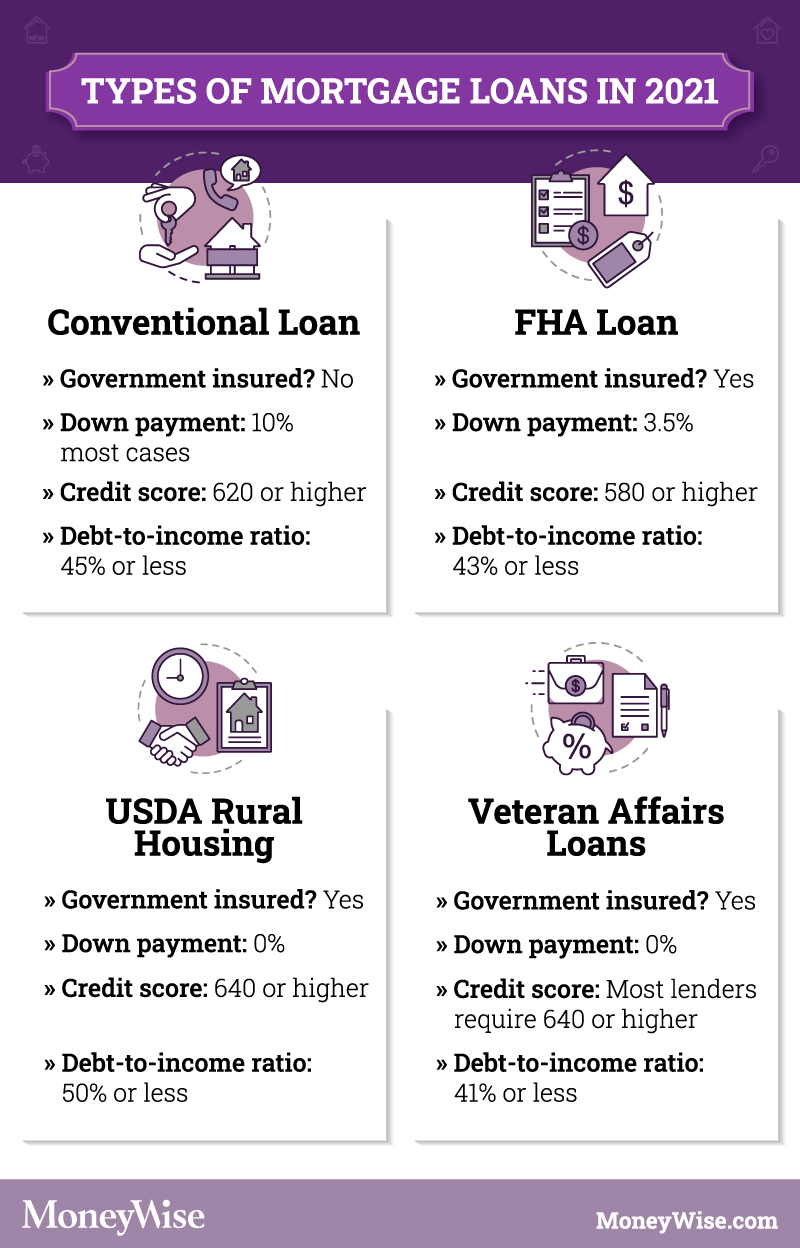

And often, interest rates and other loan pricing are competitive with those of loans available to borrowers with higher credit scores. The conventional 97 LTV loan is for first-time homebuyers of any income level who have a credit score of at least 620 and meet debt-to-income criteria. Borrowers can get down payment and closing cost assistance from third-party sources. Are you a first time home buyer looking to purchase a home in California? On this page you can learn about the different types of mortgage programs that are available to first time home buyers.

You may also view the different down payment assistance programs that are currently being offered in California. The program allows 100% financing for home buyers with 580 credit scores or higher and modest income. USDA mortgage rates are often the lowest of all the low-down payment mortgage loans. CalHFA’s MyHome Assistance Program is a deferred-payment junior loan that provides up to 3.5 percent of the purchase price or appraised value to help pay for down payment or closing costs. In many cases, you can combine this assistance with CalHFA’s loan programs.

FirstHomeAdvisor.com ® is an equal opportunity housing provider for first-time buyers. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

Eligibility requirements vary by county, so you’ll want to speak with a Down Payment Assistance specialist regarding income limits, sales price limits, and other eligibility criteria. Another option is to use our Eligibility Calculator to see what programs are right for you. The IRS allows qualifying first-time homebuyers a one-time, penalty-free withdrawal of up to $10,000 from their IRA if the money is used to buy, build, or rebuild a home.

You have the lowdown on California’s assistance programs for first-time buyers, and you’re ready to get the ball rolling. However, it has vetted a list of approved lenders you can reach out to. Generally, lenders have their own borrowing requirements, and interest rates vary. Shop around with a few different lenders to ensure you’re getting the best deal. A Federal Housing Administration, or FHA, mortgage is one of the best loan options for a first-time homebuyer.

If you would like to get pre-approved for a mortgage, we can help match you with a lender that offers first time home buyer loans in California. Non-Prime Loans – If you do not qualify for any of the above types of loans, you may consider a non-prime or non-qm loan. These programs are especially helpful to self-employed borrowers, and a variety of people with credit issues (such as low credit scores and/or a recent bankruptcy, foreclosure, or short sale). Regardless of your situation, you may want to learn more about non-prime loans if you do not qualify for any of the other types of mortgages featured above.

Buying a home for the first time can leave you with serious sticker shock. That’s especially in true in California, which has some of the highest property prices in the U.S. Those looking to crack the homeownership barrier in The Golden State can take advantage of several programs to help with the down payment and closing costs. Credit scores are certainly not the only qualification requirement for first-time buyers who need mortgage financing. There are other requirements as well, including the debt ratios mentioned below.

This type of loan is a subordinate loan, meaning it doesn’t have to be paid until the home is paid off, sold, or refinanced. The loan is limited to 3.5% of the home’s purchase price or appraised value, whichever is lower. For many first-time homebuyers, saving up for a down payment and closing costs is one of the most daunting challenges to homeownership.

FHA LOANS - FHA loans are best for low credit scores and low down payments.With a credit score of 580 or higher, the Federal Housing Administration allows for down payments as low as 3.5%. With scores as low as 500, the FHA will insure loans to borrowers with a 10% down payment. However, mortgage insurance is required for the life of the FHA loan and cannot be canceled. Many government and nonprofit homeowner assistance programs are available to people with low credit scores.

No comments:

Post a Comment